Is it worth it? It is!

Typically, quality parts deliver the best return on investment (ROI) for fleets. That’s because parts that last longer before requiring replacement and perform reliably during operation simply have a lower total cost of ownership (TCO) for trucking fleets.

The cost of parts and labor required to replace a component is compounded by the vehicle downtime and likely an unhappy customer. A part that lasts longer between a replacement or possibly the end of the vehicle life cycle within a fleet has multiple advantages. Phillips Industries recognizes this and has built a supplier base and manufacturing capabilities to support its earned reputation for producing the highest quality air and electrical components for today’s trucks and trailers.

Parts distributors have relied on the Phillips brand for quality and innovation to successfully build their businesses supplying fleets with parts that will deliver the best performance for their operations. OEM’s also overwhelmingly make Phillips’ components standard on their vehicles because they know their customers will be satisfied with this choice, solidifying their quality reputation.

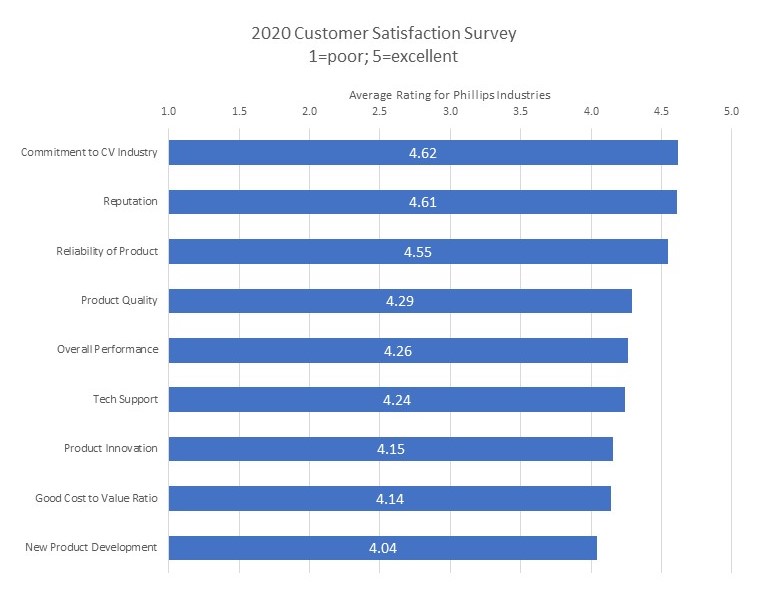

The following graph from a 2020 Customer Satisfaction survey (of 50 trucking fleets) reflects the high regard for Phillips’ products.

Phillips’ products rarely have the lowest acquisition cost, but fleets continue to ask for them, paying a premium for the attributes associated with the brand – quality, durability, reliability.

While Phillips Industries is experiencing higher than average and more volatile cost increases for everything from raw materials to transport costs, they know their customers and end-users of their products are experiencing similar challenges. Every department at Phillips has been charged with finding efficiencies to mitigate the impact of these surging cost increases while maintaining the quality Phillips customers have come to expect.

It’s an unavoidable fact that prices for just about everything have increased significantly throughout 2021, including shipping costs. The accelerated rate of the increases has caught most (including expert industry and economic forecasters) by surprise.

As a September 13 Time Magazine article “Everything is Expensive” explains, prices are going up everywhere and for a mix of reasons. The report follows the circuitous route of Jani, a 4-ft plush giraffe, from its manufacturing point in China to its journey’s end at the author’s apartment in San Francisco. Unlike material cost increases such as Phillips and other hard part manufacturers are experiencing, Jani’s manufacturer, Viahart, “didn’t have to pay more to make Jani,” but “getting Jani to the U.S. would prove much more expensive.” The container required to transport Jani from China to the U.S. quadrupled from $4,700 to send a 40-ft container before the pandemic to around $21,000. The balance of the logistics required to get Jani to its buyer finally is a story of mounting delays and related costs associated with the current capacity crunch in trucking and other surface transport.

Costs went up at every leg of the journey, and transfers were delayed as Jani moved through the network.

A July 8, 2021 article, “Everything feels more expensive because it is,” points out that prices for “used cars and trucks…went up 7.3 percent in May, after going up 10 percent in April. Used car prices are now up nearly 30 percent since last year… due to supply chain disruptions in the new car market, including a global shortage of semiconductor computer chips…The cost of kitchen and living room furniture, due to a mix of supply chain bottlenecks and demand to fix up our personal spaces during the pandemic, is up about 10 percent since last year.” Other cost increases tracked from May 2020 to May 2021 included: gasoline +56.2%, fuel oil +58.8%, natural gas +13.5%, and transportation services +11.2%.

Both above articles cover a wide range of cost increases affecting “everything” which of course impacts our industry and for which our industry – transport –plays a starring role.

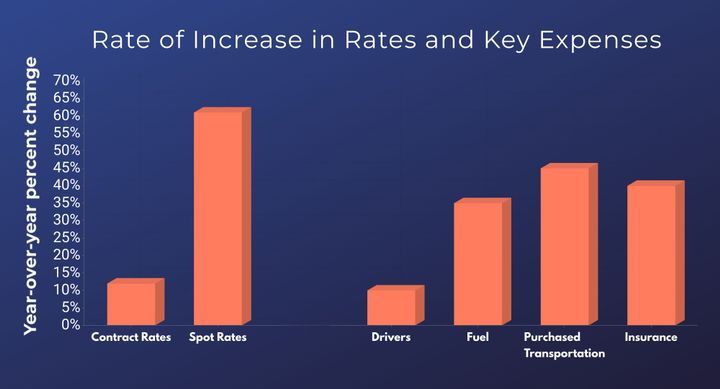

For a more relevant article on the costs that impact Phillips’ products, on July 21 of this year, Heavy Duty Trucking posted “What Does Inflation Mean for Trucking” and included the following chart with relevant year-over-year cost increase rates.

The over-arching theme of this piece is the effects of the pandemic on shutting down demand and then reversing course fairly quickly to increased demand for mostly “everything” – causing bottlenecks at manufacturing and distribution points and extremely tight capacity in the ability to move goods economically. It’s basic Econ 101 theory of supply vs. demand impacting costs (and ultimately pricing).

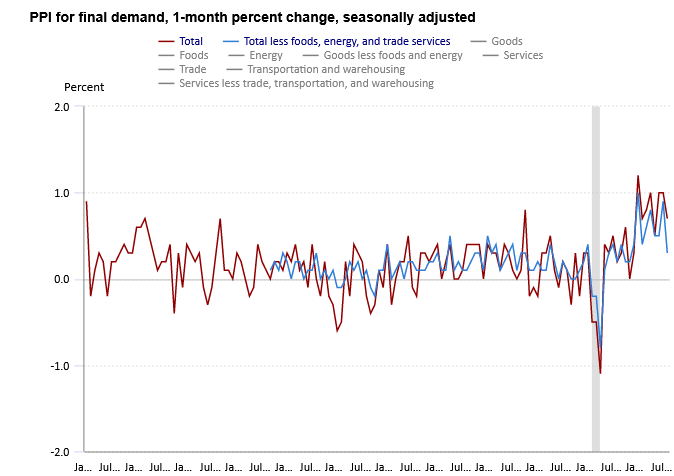

For a clear visual of rising prices, we relied on the U.S. Bureau of Labor Statistics – September 10, 2021: “Producer Price Index News Release.”

Phillips Industries, like other producers, has felt the impacts of these cost increases over the past 18 months.

There is a cost associated with consistently producing quality parts which involves buying quality components and sticking with known quality suppliers in a time of uncertainties across the globe, and investing in quality manufacturing facilities. Phillips Industries is unwilling to compromise the quality reputation they have built over almost a century of supplying the commercial vehicle industry by chasing the lowest cost alternatives (in material, suppliers, or pricing levels).

Nevertheless, Phillips is looking at everything to lessen the burden of incurred cost increases on their customers.